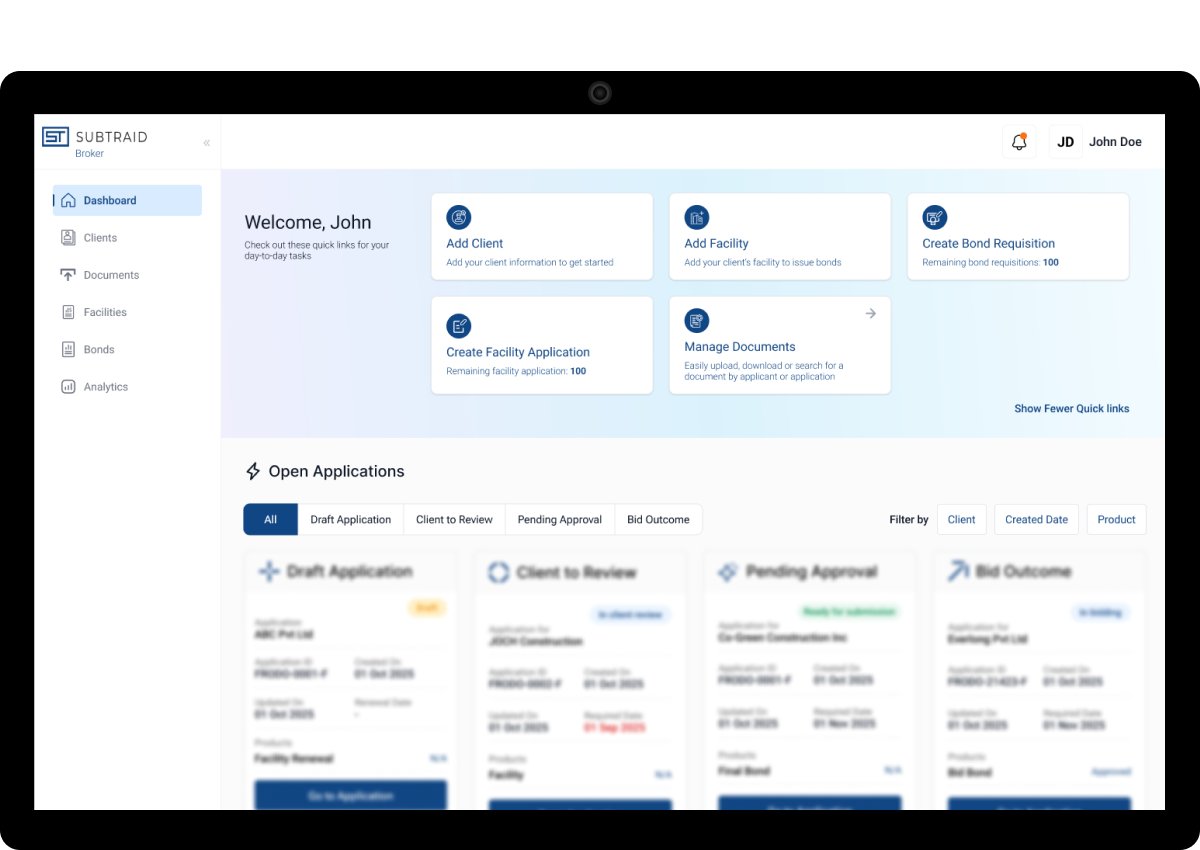

Surety Application for Construction Projects, Simplified.

From a manual process that can take weeks to a cloud-based platform that can prepare an application in a day.

Trusted by

Turner Surety and Insurance Brokerage, Inc.

From Create to Manage in 4 Simple Steps

How Subtraid simplifies the surety application process.

1.Create Client Profile

With basic information like legal name of company and contact information.

2.Auto-Fill & Complete

With trusted third-party data & collaborative client portal to request / submit information directly.

3.Review & Package

Create professional, underwriter-ready application to submit.

4.Manage Bond Program

Create requisitions, track compliance, monitor capacity & tap into powerful analytical insights.

A Better Experience In Less Time

Spend less time on admin tasks and more time advising clients and growing your business.

Faster Applications

Time savings through a streamlined application process enabled by integrations, AI, and analytics.

Easy Collaboration

Improve client experience through a shared online portal for seamless communication and faster submissions.

Verified Data

Increase underwriter confidence with verified data from trusted, industry-standard sources- automatically built into every application.

Work Smarter

Drive growth and boost revenue by enhancing efficiency-do more with less.

Features Built by Surety and Data Experts

Engineered by Surety Specialists and Data Professionals

-

Digital forms, smart uploads and pre-filled information to streamline workflows.

Proactive alerts for stalled applications or missing information.

Download clean, structured submissions—professionally packaged and ready to be marketed to underwriters.

-

Centralized dashboard of all active applications and status.

Instant access to the most critical details of your client’s surety bond facility and get a clear view of all bond activity.

Tracking for compliance and capacity.

-

Financial documents turned into easy-to-read digital statements with AI.

Automatic analysis of key areas like cash flow, profit, debt, and efficiency.

Clear, actionable insights to better understand a businesses’ financial health.

-

Client portal to centralize and organize communication.

Clients can submit information, track application status and collaborate directly with brokers.